As inflation stubbornly clings to the U.S. financial system, individuals are more and more searching for options, and on the high of the checklist is that this one: Why not simply print more cash? And why not do it with out telling individuals, in order that it doesn’t backfire with much more inflation?

The thought pops up throughout, and the approaches to explaining it vary from Jack Corbett on NPR’s common Planet Cash TikTok channel to a dialogue on the “ask science” subReddit to varied YouTube contributors like Cash & Macro.

This isn’t essentially a sensible query, however might be extra about financial concept at a elementary degree, like why can we even have this monetary system? And if our cash provide is really in our management, why don’t we simply repair it?

As of late, the massive imponderables concerning the world are summed up briefly sardonic movies with rights-free soundtracks and clip-art graphics on TikTok, Reddit, YouTube and different social media channels. They’re supplemented by copious quantities of feedback, and the entire bundle taken collectively turns into a type of main supply materials that has a wider attain than most textbooks.

Some 60% of younger individuals get monetary data from social media, in accordance with the Finra Basis, which may result in some fairly dangerous investing habits in choices, cryptocurrency and meme shares. In my family, these social media objects on monetary literacy attain me by way of texts from my youngsters, who ship clips alongside and ask me if no matter is being stated is true. So possibly slightly fact-checking is so as, particularly as a result of a few of the ideas being batted round will not be really easy to know, even for the specialists.

So, then, what’s the reply?

As a substitute of asking an AI chatbot to clarify, I turned to economist Larry Kotlikoff, a professor of economics at Boston College. Whereas the reply to this explicit query appears simple—printing cash is mostly what causes inflation, cue pictures of ineffective paper cash in wheelbarrows—it’s clearly extra difficult than that, particularly regarding at the moment’s inflation and what to do about it. January’s inflation numbers kicked off 2023 with combined messages, with the CPI exhibiting inflation easing, however possibly not as rapidly as omelet-lovers and others would love.

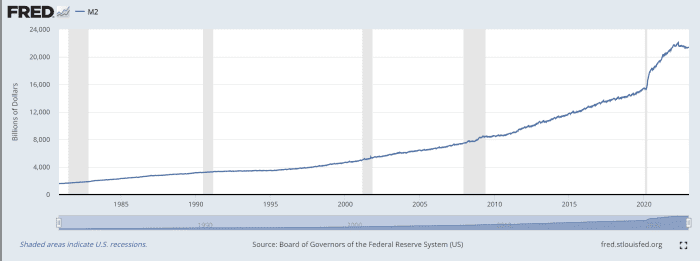

First, with regard as to if or not the printing of cash is secret or open, it’s a matter of the way you outline transparency. The U.S. authorities releases information concerning the financial provide and the way a lot new cash it’s printing, however Kotlikoff doubts that most individuals are going to the Federal Reserve to investigate the newest information on M2, which is the measure of the forex held by the general public, plus deposits and shares in retail mutual funds.

“It’s not like hundreds of thousands of individuals go to the St. Louis Fed web site,” to verify the financial provide earlier than heading to the grocery retailer, he says. So the presumption that data about what the federal government does influences how individuals react may be overreaching slightly. Even when they’re studying about it not directly by means of tutorial or information shops, it’s nonetheless unlikely affecting their day by day buying practices in a approach that might swing inflation measurably.

That stated, Kotlikoff says that economies that don’t have any public reporting concerning the financial provide depart individuals guessing, and that may be unstable. He factors to Argentina, the place the central financial institution prints cash and no one has any concept, in order that they don’t belief something.

“Everybody assumes a lot larger inflation will come up than they need to, and you’ve got a self-fulfilling prophecy—I elevate costs as a result of I believe you’re elevating costs, and staff demand extra wages. Then it’s off to the races,” says Kotlikoff.

Plenty of cash is already being inked

For all these suggesting printing more cash, Kotlikoff says that we’re mainly already doing that. Should you do occur to go to the St. Louis Fed web site, you may see that the M2 financial provide has been steadily growing, with an enormous bounce in 2020.

Board of Governors of the Federal Reserve System (U.S.)

However that’s not essentially what’s inflicting our spike in inflation now, and printing more cash is just not the one factor that may repair it. “What’s causal is dicey,” says Kotlikoff. “The M2 has elevated dramatically since 2008, and for a few years, it grew and costs didn’t go up.”

The massive spike in 2020 was due to Covid-relief spending, for probably the most half, after which costs began to go up. Now costs are coming down, inflation is easing and M2 is coming down as properly. “That’s as a result of rates of interest are larger and other people aren’t borrowing as a lot,” says Kotlikoff.

There’s additionally much more occurring than that, together with Federal Reserve motion on rates of interest, authorities spending and exterior political and pure elements like battle and climate disasters. So you may’t draw a clear line exhibiting an in depth connection between the financial provide and worth ranges, and meaning there’s not a easy answer like printing cash to resolve inflation.

“If the inventory market goes up at the moment and my cat meows 3 times, there’s an in depth connection there too,” Kotlikoff says.

Now that’s a proof my teenagers can admire (however not a lot our canine).